EUR 9m green bond issue for Recap Energy has been successfully completed with JOOL as corporate finance advisor

Feb 2, 2023

The green bond issue was well received by the market and once again shows the increasing interest in green investments.

Recap Energy AB (publ) is a Swedish renewable energy project developer offering solar-PV and Battery Energy Storage Solutions. Recap has operations in 6 different markets where they have developed 34,8 MW and signed an additional 416 MW of contracts across its business areas.

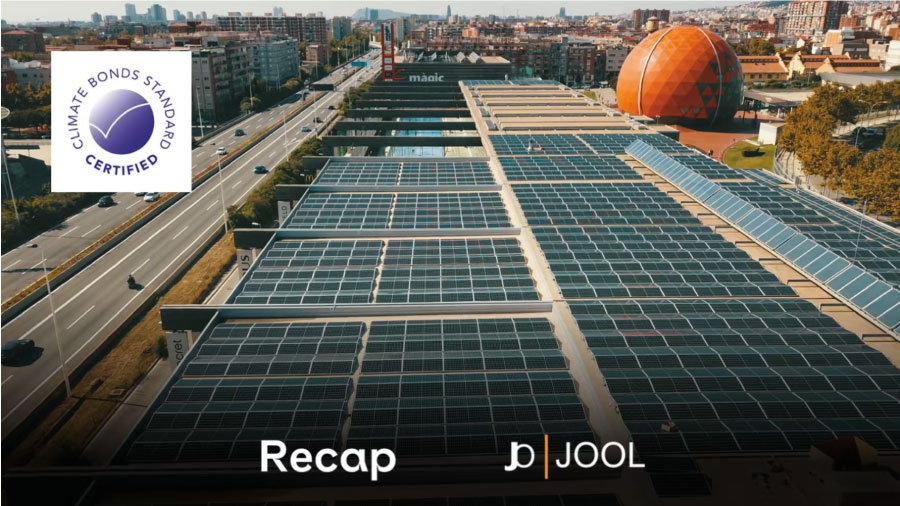

Since 2016, Recap has developed a ~10 MW Commercial and Institutional rooftop solar power portfolio in Spain. The portfolio, which is almost fully commissioned and deployed, has now been acquired from its equity partner and refinanced through, amongst other sources, issuance of green bonds and a local senior bank loan from BankInter. The bonds bear a coupon of 10 % p.a. + EURIBOR 3m with quarterly interest payments. Maturity is 24 months (-12 / +12 months).

JOOL Corporate Finance acted as Corporate Finance advisor, and Setterwalls Advokatbyrå AB acted as Corporate Finance Legal Advisor to Swedish Law and CMS to Spanish Law. The bonds will be registered through Euroclear Sweden.

“We are very excited to have closed this refinancing for our first solar portfolio in Spain. It is a landmark deal for us, being among the first developers in Europe to finance a Commercial and Industrial solar pv portfolio of this size through the bond market. This placement is well in line with our strategy to build, through aggregation, diversified and resilient C&I portfolios that can access debt capital markets for refinancing on their own merit. With the recent programmatic certification by the Climate Bonds Initiative, we look forward to building on this success to issue further securities in solar energy and energy storage in the coming years.” says Marco Berggren, Founder and CEO at Recap Energy.

“We are happy and proud with the completion of another green bond issue for a company with sustainability at the core of its business model. The transaction is proof of our strengthened position within sustainable financing,” says Ola Nilsson, CEO and Managing Partner at JOOL Corporate Finance.

“This exciting new Certified bond proves that the market has a tremendous appetite for credible, ambitious sustainability projects. Investors value credible product more so as EU regulation expands, therefore for issuers adopting market best practice is the best means to getting into their sustainability portfolios.” Says Sean Kidney, CEO and co-founder of the Climate Bonds Initiative.

Read the press release HERE.